August Market Thoughts

The Silly Season Gets Serious

July Recap and August Outlook

The hot days of high summer are usually regarded as the “silly season” because, lacking important news, the media tends to look for trivial material that will capture viewers. Not this year. July saw an unrelenting spate of tariff news, shock firings of high-profile government personnel, and the President feuding with the Fed.

The month started with a very soft economic picture that made all the angst and projections of economic ruin over tariffs we saw in the first few months of the year seem an overreaction. The erratic policy process slowly turned into actual agreements, and the markets appeared to adjust to the process. Recession expectations receded, and with the labor market continuing to remain strong, and inflation slowing, the likelihood of rate cuts in September was reduced.

The Fed’s July meeting, at the very end of the month, produced a predicted stasis on rates, with Chairman Powell stating no decision had been made on a rate cut in September, which was interpreted as meaning the likelihood of a cut was low.

Let's get into the data:

Inflation, as measured by CPI, rose less than expected. For the 12 months ended in July, CPI was 2.7%. The monthly number rose 0.2%.

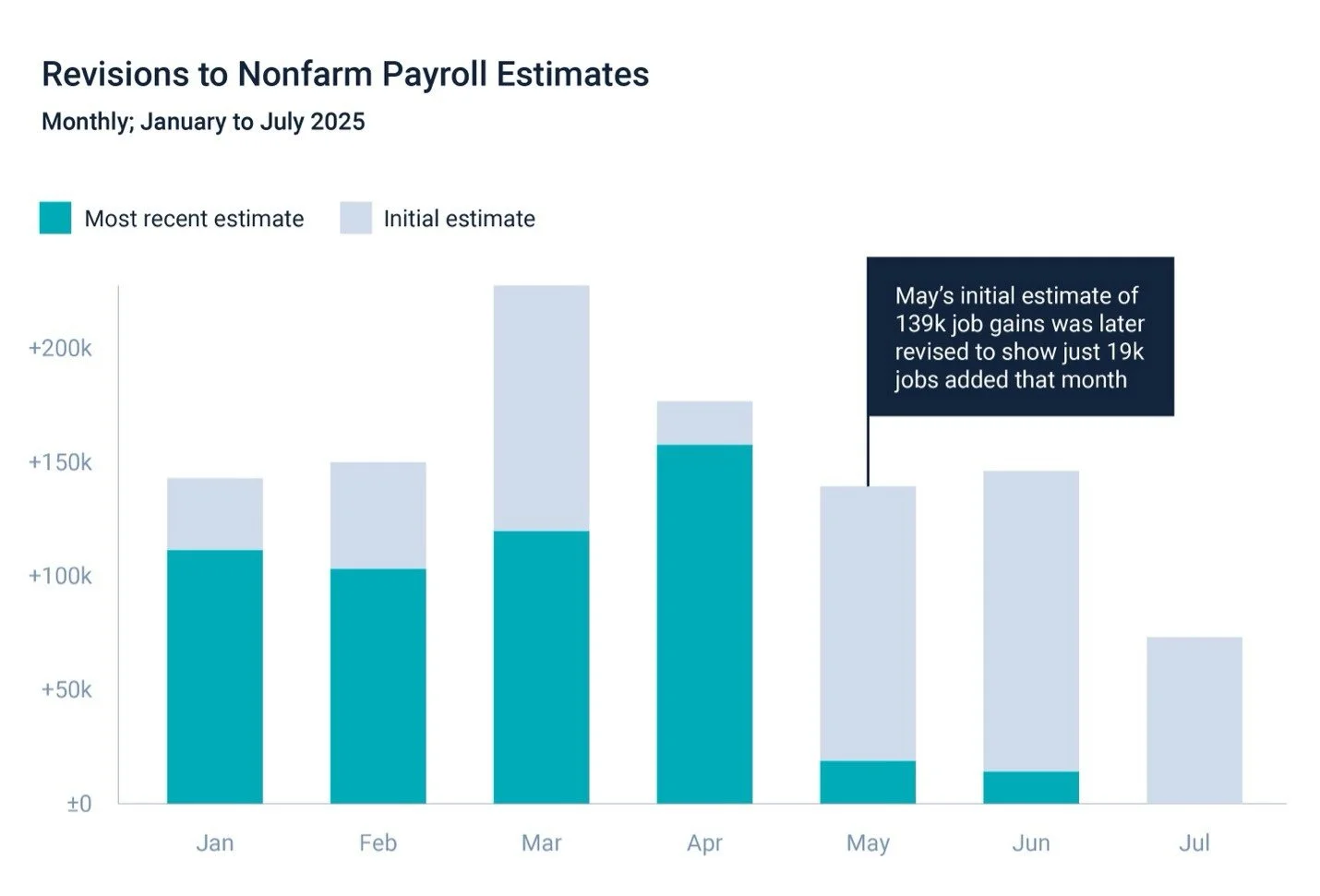

Non-farm payrolls for July came in at 73,000. The U.S. Bureau of Labor Statistics reported that the labor market added significantly fewer jobs than the low prediction of 100,000 that were expected. June and May were also revised lower.

Retail sales increased by 0.6% in June. The number is not adjusted for inflation, and was more than double economists’ expectations.

GDP increased by 3.0% in the second quarter. The Bureau of Economic Analysis reported that the advance estimate of second quarter GDP increased primarily due to a decrease in imports.

What Does the Data Add Up To?

The annual increase in inflation was the highest since February but still came in lower than economists’ expectations for 3.1%. As usual this indicates a modest impact from tariffs. After months of news constantly hammering the tariff scare, there seems to be a pattern developing…

Are investors who have been enjoying a strong stock market and feeling the wealth effect from increased home values displaying confidence in the economy? According to Moody’s Analytics, not really, as spending growth among the top 20% has flatlined in 2025, after robust growth in both 2023 and 2024.

What will the Fed make of these two data points, as it gets close to the end of the year? Chairman Powell has long been citing the dual mandate of the Fed in creating full employment while keeping inflation in check. With the downward revisions to non-farm payrolls released last week, and two months of lower-than-expected employment numbers, inflation that is accelerating less than anticipated may take a backseat to bolstering the economy by lowering rates.

Chart of the Month: Is the Labor Market Telling a Worrying Story?

After months of perceived strength, this summer has brought a revised view of the labor market. Two months of the largest revisions on record have brought to light an underlying weakness in the labor market.

Source: Bureau of Economic Analysis (data) Axios (visual)

Equity Markets in July

The S&P 500 was up 2.17% for the month

The Dow Jones Industrial Average gained 0.08% for the month

The S&P MidCap 400 rose 0.85% for the month

The S&P SmallCap 600 increased 3.85% for the month

Source: S&P Global. All performance as of July 31, 2025.

Six of the eleven S&P 500 sectors had positive returns, with Information Technology maintaining the lead again, up 5.16% and Health Care in last place, down 3.44%. Monthly intraday volatility, measured as the daily high/low, decreased again, to 0.63%. None of the 22 trading days in July saw a move of 1% or greater. Earnings season is more than half complete, with 284 issues reporting. Of these 223, or 78.5%, have beaten earnings expectations.

Bond Markets in July

The 10-year U.S. Treasury ended the month at a yield of 4.36%, up from 4.24% the prior month. The 30-year U.S. Treasury ended June at 4.78%, up from 4.92%. The Bloomberg U.S. Aggregate Bond Index returned -0.22%. The Bloomberg Municipal Bond Index returned 0.32%.

The Informed Investor

With a decline in interest rates looking increasingly likely in September, how can investors prepare? Whether the rate cut is 50bps, 25 bps, or doesn’t happen at all until later in the year, it shouldn’t make that much of a difference to a well-thought-out plan. Focusing on the big picture of your plan can make an even bigger difference. The Big Beautiful Bill has brought opportunities to rethink tax strategy and tune up your deductions to take advantage of the new provisions. These range from increases to the standard deduction all the way up to new deductions, such as the $6,000 deduction for taxpayers 65 and older. Taking a careful look now and then planning for year-end can help you implement a tax strategy that keeps you on track for your wealth goals.

Safe Lock Advisors, LLC dba Prevett Financial is an investment adviser registered in the State of Kentucky and those states in which is conducts advisory business or is exempt from registration. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. Prevett Financial has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. Prevett Financial has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Prevett Financial has provided charts or graphs which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them.

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA